The BRAIN Biotech Share

BRAIN Biotech AG is a growth company with a focus on industrial biotechnology. In addition to the general capital market environment, sector-specific conditions and investors’ risk appetite, the main share price drivers are the future and growth prospects for BRAIN Biotech AG. In particular, the share responds with greater volatility to news flow concerning progress made with projects from the BRAIN BioIncubator, which contains some of BRAIN Biotech’s key future projects. Continued organic growth, improved profitability, and the successful integration of acquired companies are further key drivers of the share’s price performance.

In February 2024, BRAIN Biotech added an equity-linked component to its existing financing instruments by issuing a € 5 million convertible bond. This has broadened the foundation for the financing of growth initiatives and for general corporate financing.

Moreover, BRAIN Biotech has strongly advanced its development in the BioIncubator area through the commercialization of pipeline investments. As a first step, the company received a significant milestone payment of € 1.5 million in the second quarter from licensee Pharvaris for successful development progress in the out-licensed drug program for Deucrictibant (formerly PHA 121). In a second step, BRAIN Biotech signed an agreement with Royalty Pharma in September 2024 for the monetization of the licensing rights to the investigational compound Deucrictibant for an amount of up to € 128.88 million. This transaction has significantly brought forward the expected cash proceeds from the "Deucrictibant" project, thereby accelerating the ongoing transformation of BRAIN Biotech into a global top ten player in the highly attractive market for industrial enzymes.

Share price performance1

| Price at the start of the financial year | Price at the end of the financial year |

High for the financial year |

Low for the financial year |

12M share price performance |

|---|---|---|---|---|

| € 4.24 | € 2.12 | € 4.45 | € 1.45 | -50.00 % |

|

01.10.2023 (first trading day 02.10.2023) |

30.09.2024 |

04.10.2023 | 12.09.2024 |

1 In each case based on the XETRA closing price

Performance of the BRAIN Biotech share in the 2023/24 financial year (indexed)

Key share data1

| Share class | No-par-value registered shares |

|---|---|

| Stock exchanges | All stock exchanges |

| Transparency level | Prime Standard |

| Number of shares | 21,847,495 |

| Share capital | € 21,847,495 |

| ISIN | DE0005203947 |

| WKN | 520394 |

| Ticker symbol | BNN |

| Specialist | Baader Bank AG |

| Designated Sponsor | Baader Bank AG |

| Paying agent | Bankhaus Gebr. Martin |

| Share price on 30.09.2024 | € 2.12 |

| 52-week high | € 4.45 |

| 52-week low | € 1.45 |

| Market capitalization as of 30 September 20242) | € 46 million |

| Average daily trading volume (52 weeks as of 30.09.2024) |

11,454 shares (Xetra) 13,902 shares (Tradegate) |

1 In each case based on the XETRA closing price

2 Last trading day of the 2023/24 financial year

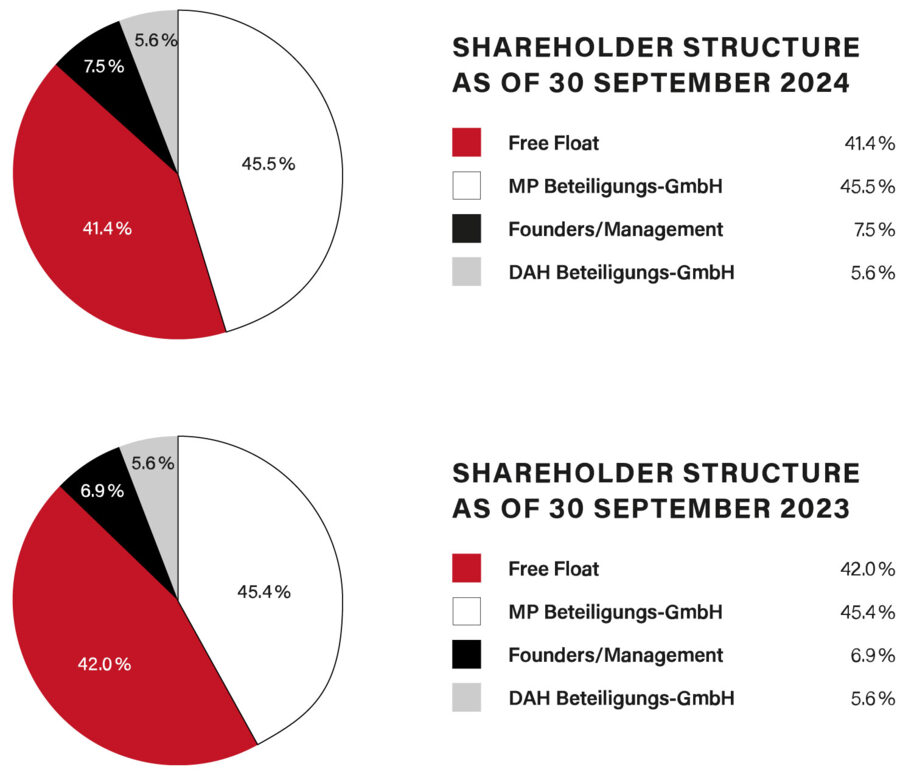

Shareholder structure

The free float stood at 41.4 % as of 30 September 2024. The shareholder structure of BRAIN Biotech AG as of 30 September 2024 (and as of the previous year’s reporting date) was as follows:

Analysts

Estimates and recommendations relating to BRAIN Biotech AG are published by the following research houses (as of 30 September 2024):

| Company | Analyst |

|---|---|

| Baader Helvea Equity Research | Thomas Meyer |

| Deutsche Bank AG | Jan Koch |

| FMR Frankfurt Main Research AG | Dr. Mohamad Vaseghi |

| Kepler Cheuvreux | Nicolas Pauillac |

| M.M. Warburg & Co. Bank | Dr. Christian Ehmann |

Financial communication

BRAIN Biotech AG is listed on the Frankfurt Stock Exchange in the Prime Standard segment of the Regulated Market, the stock exchange segment entailing the highest transparency requirements. Along with corresponding mandatory publications including quarterly statements and the half-year financial report, BRAIN Biotech informed investors, analysts, and other interested capital market participants in a total of two ad hoc announcements, 14 press and investor relations announcements, as well as through telephone conferences and numerous individual meetings, about the company’s further development as well as the bioeconomy’s global growth potential. The Management Board and the Head of Investor Relations were repeatedly available for discussions in the context of one-on-one visits to Zwingenberg – as well as participation in relevant conferences such as the Spring Conference and the German Equity Forum in Frankfurt as well as the Baader Investment Conference in Munich. Key topics included the continued strong growth prospects in the product business, progress on projects in the BioIncubator and the monetization of BRAIN Biotech’s investments from the BioIncubator pipeline.

The declared objective is to position BRAIN Biotech in the top 10 companies of the global enzyme market in the medium term by doubling its revenue generated with industrial products. BRAIN Biotech operates in this area as a global multi-niche enzyme company. Financial announcements and publications as well as all other publications of relevance to the capital market are permanently available on the company’s website at www.brain-biotech-group.com/en/investors/.

Annual General Meeting

On 12 March 2024, the eighth Annual General Meeting of BRAIN Biotech AG was held as a physically attended event again, at the Melibokushalle in Zwingenberg, following a three-year period during which the AGM had been held as a virtual event. Of the share capital of BRAIN Biotech AG of € 21,847,495.00, which is divided into 21,847,495 no-par-value registered shares, a total of 14,417,113 shares entailing the same number of votes (including postal votes) were represented at the AGM. Depending on the agenda item, the shareholding at the time of voting was between 65.74 % and 65.94 % of the share capital of BRAIN Biotech AG. The voting results are published on the Internet at https://www.brain-biotech-group.com/en/investors/annual-general-meeting/.

The votes related to the ratification of the actions of the Management and Supervisory boards for the 2022/23 financial year, the approval of the conclusion of two agreements concerning the establishment of a typical silent partnership between BRAIN Biotech AG and Hessen Kapital I GmbH, and an agreement with MBG H Mittelständische Beteiligungsgesellschaft Hessen mbH. Votes were also held concerning the election of the auditor of the annual separate and consolidated financial statements as well as the approval of the compensation report.